Introducing SecurityAnalysis.ai

Documenting My Adventures in Burning & Compounding

Coming Out of Stealth

Dear friends,

I’ve decided to start writing publicly about two parts of my life that I have up until now kept firewalled: building startups and investing in public companies.

If you are receiving this email, I value your opinion and either want to keep in touch with you or get back in touch with you. So I’ve taken the liberty of subscribing you into this newsletter. Below I’ll explain what I’ve been up to and what you can expect from my writing, but if you’d rather not receive this please feel free to unsubscribe - my feelings won’t be hurt, pinky promise.

1. What will this newsletter cover?

To give you a flavor for what you can expect, here are a few titles of future blog posts:

Investing in the Age of Infinite Intelligence

What Torching $5M Dollars and 6 Years of Your Life Feels Like

Meta $5000

What Consoling 9000 Heartbroken Women Taught Me About Value Investing

Why I Invested 40% of My Net Worth In a “Shitco” Run By a Pro Gambler

And more 🙂

2. Why should you give one half of two schnitzels about what I have to say?

This is an excellent question, so let’s look at the data:

My record as a startup founder: I’m 0 for 2. My first startup was bootstrapped and my second was venture backed with millions of dollars by some of the best early stage investors on earth. Both were zeroes. I’ll have a lot more to say about this later, but for now all I’ll say is ouch.

My record as a public markets investor: I've been fortunate to be a concentrated investor in a number of companies including Shopify (58x), Sea Ltd (30x), Carvana (25x), Meta (6x) and Blend Labs (5x). On the basis of this track record, I've started managing a small amount of external capital for a few families.

I have no f*cking clue if I’ll be able to keep this up and I’ll be the first to acknowledge the role of luck in investing. Compounding with small starting amounts of capital is a lot easier than compounding hundreds of millions of dollars and I’m also aware of the importance of humility in investing, so this will be the first and last time I share these numbers publicly. Still, I thought it important to establish my bonafides.

3. Why start writing now / what took you so long?

I finally managed to resolve an existential knot that has been vexing me for my entire professional life: am I a tech bro or a compounder bro?

I’d like to say it was the countless hours of therapy or months of travel that helped me resolve this identity crisis, but actually it was anonymous Buddhist monk #2 in Episode 1, Season 3 of White Lotus (Same Spirits, Different Forms) who dropped this pearl of wisdom:

“Identity is a prison. We build the prison, lock ourselves inside, then throw away the key.”

Hot damn.

As those words pierced my skull, I brushed the Dorito dust off my pajamas and realized I didn’t need to pick between these two identities.

There was a third option that felt deeply true to me and allowed me to escape the identity prison: I’m just a deeply curious person.

IMO (good) startup founders and hedge fund investors tend to have diametrically opposite personalities and hate each other's guts, but really they are both just abnormally curious people who look for opportunities and act on them with force of conviction.

There was a third option that felt deeply true to me and allowed me to escape the identity prison: I’m just a deeply curious person.

4. What is in this for you Rush?

Another great question, understanding incentives is important! If you are receiving this email from me, I want to stay in touch with / reconnect with you because I value your opinion. Also, a big motivation to write publicly for me is to get disconfirming evidence and get pushback on my (frequently heretical) ideas, so if anything I write tickles your brain, please hit reply!

5. What’s next?

Before I let you go, I have a quick favor to ask you:

Can you reply "received" to this email?

If this email ended up in a spam, promotion, or social folder, please move it to your primary folder! On Gmail, you can do this by clicking the three dots in the top right corner of this email, selecting “move”, and clicking on “primary”.

"Dude, you’re sending me emails on a Sunday… I just want to read your blog in peace. Why the extra steps?" Another great question! Let me explain:

Replying "received" tells your inbox to trust SecurityAnalysis.ai emails, so they won't end up in your spam folder.

The whole process will take less time than it took you to read this sentence so far: one "received" reply to this email, and move the email to your primary inbox if needed.

6. Bonus

We’ve entered an incredible, unprecedented period of history with everything around us accelerating all at once. As a startup founder I’m an unapologetic optimist. As an investor, I’m a bit of a skeptic. Navigating this period is going to require equal doses of both and it will be fun to do it together.

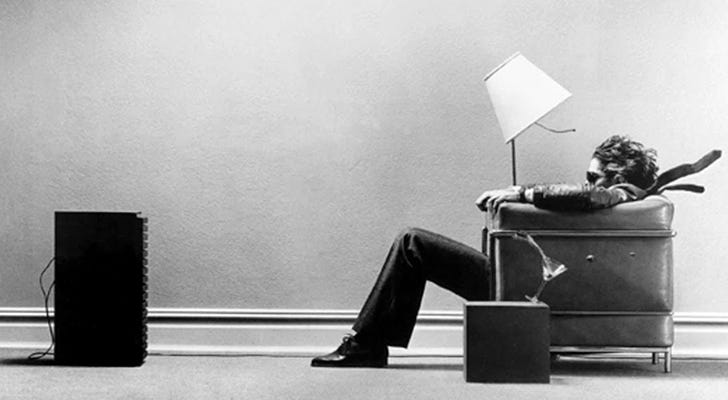

So until the next post I’ll leave you with my favorite artwork; Maxell’s “Blown Away Guy” (pictured below). The man is shown desperately clinging to the armrests but defiantly looking ahead at the source of the music through his sunglasses while his hair, necktie, the lampshade and his martini glass are being blown back by the tremendous sound from speakers in front of him supposedly due to the audio accuracy of Maxell’s product. Can’t think of a better metaphor for the paradigm we are in.

Stay curious,

Rush

www.securityanalysis.ai

https://x.com/updating_priors

i got the META 2022-now bounce, but missed the rest. thinking of doing BLND because of your blog...drive pass their office once in a while. they have a nice sign there.