$PSNL: Cancer Diagnostic Company On the Cusp of a Dramatic Inflection

$520M EV cancer testing co with a path to $100M EBIT in 2029 from a product that is less than 1% of their sales today. Deeply underestimated, $PSNL has the potential to 4x from here in short order.

Life update: Earlier this year a friend and I quietly started a new company. Excited to share that we have been backed by YCombinator and I have relocated to SF for the remainder of the year. Unsurprisingly, we are building a fintech and no it is not another AI investment analyst, that would be lame. I am going to go off-grid for the next few months, but wanted to get this write up on Personalis that has been marinating in my head into the world before I do.

Whether I am building a business from scratch or buying a stock, I look for the same four things:

A large and growing market, ideally more than $10B

A 10x better product

Compelling unit economics

A moat that will allow the company to capture the benefits of their unit economics for a very long time

In public markets, there is an additional fifth condition that must be met: the market should not have already priced in all of the above.

Personalis ($PSNL) satisfies all five conditions for me.

The company has developed NeXT Personal, an ultra-sensitive blood test that can detect cancer recurrence far earlier than traditional methods. The test works by finding circulating tumor DNA (ctDNA), the tiny fragments of DNA that cancer cells release into the bloodstream. By picking up these traces, NeXT Personal can identify recurrence up to 12–18 months before a CT or MRI scan would show anything. In effect, Personalis has turned a simple blood draw into an early-warning system for patients already diagnosed with cancer.

At $7.30 a share, $650M in market cap, $174M in cash and zero debt, the market thinks Personalis is a sub-scale, no-moat, cash-incinerating diagnostics company whose best in class blood test for cancer recurrence (NeXT Personal) has no chance against Natera ($23B) and Guardant ($8B) because both of them have larger sales forces pushing “good enough” alternatives.

I believe the market is wrong and this disconnect presents an opportunity to 4x (and potentially a whole lot more) your money in the next 18 months with an imminent catalyst in Q4 ‘25.

The catch, and the source of this opportunity, is one of perspective. I am not a traditional healthcare investor. That said, my background as a hyper curious startup founder who spends a lot of time thinking about software and executing Go to Market (GTM) motions is precisely what allows me to see something the market is missing.

TL;DR: The NeXT Personal test is widely acknowledged to be best in class. The bear case is distribution; the market doesn’t think the test will be widely adopted. My counter is that the market hasn’t fully appreciated the value of PSNL’s exclusive distribution partnership with Tempus ($TEM, $15B), which is connected to more than half of U.S. oncologists and integrated across over 2,000 hospitals. Tempus owns 14.5% of PSNL and 2 weeks ago filed to have the option to increase their stake to 19.99%. Tumor-informed testing begins with a tissue biopsy, and Tempus controls that workflow with EMR integrations and turnkey billing. For clinicians already using a Tempus lab, adding NeXT Personal will soon effectively become a one-click decision, similar to an “add to cart” on Amazon. This isn’t something you could figure out staring at PSNL’s backwards looking financial statements, but its pretty obvious if you’ve spent time building software products. If NeXT Personal can capture 6% market share by 2029, there is a clear path to $100M of EBIT from NeXT Personal alone which currently accounts for <1% of PSNL’s revenues. At a 20x EBIT multiple, that implies roughly $2B versus a current EV of ~$500M. The rest of the business generates about $85M of revenue today and has significant embedded upside optionality.

Investing can be as easy or complicated as you want it to be. I’ll lay out a simple narrative style investment case for PSNL in Part 1, and then in Part 2 I am open sourcing a full blown hedge fund style write up with PSNL’s TAM, unit economics, a valuation model, and risks. Pushback is welcome and encouraged!

Disclaimer: I own a chunk of Personalis in a personal capacity and on behalf of funds I manage for UHNW families. I am extremely biased and this write up is not financial advice. Do your own research, don’t borrow conviction and no crying in the casino.

Part 1: The (Simple) Investment Case for PSNL

I define variant perception as holding a well-founded view that’s meaningfully different from the market consensus. - Michael Steinhardt

PSNL’s product NeXT Personal is a blood test that can detect whether cancer is coming back (i.e. recurrence) 12-18 months before CT scans pick it up.

Being able to detect the recurrence of cancer early is very important because:

it allows doctors to start/change treatment sooner which saves lives and

it enables biopharma companies to reduce the length of their enormously expensive cancer drug trials by proving or dispoving their drugs work faster

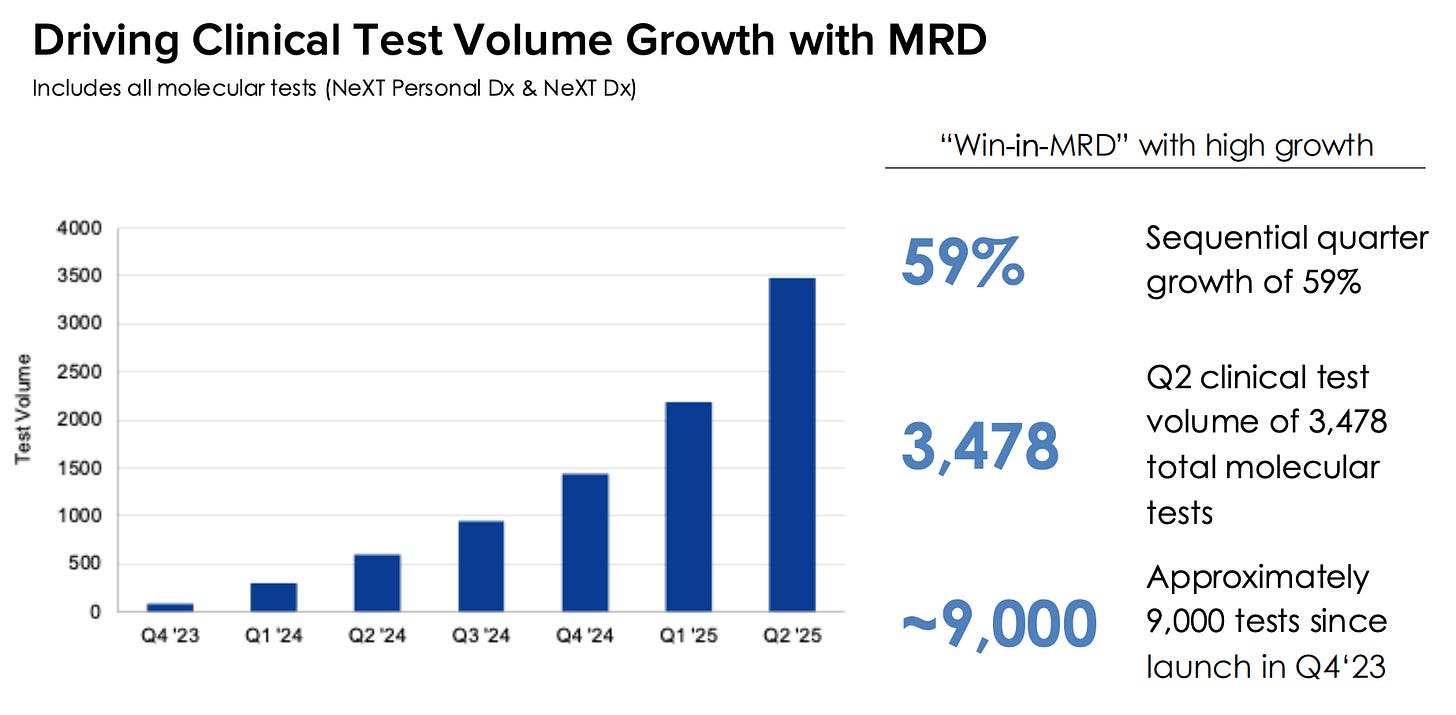

NeXT Personal currently accounts for less than 1% of PSNL’s $85M in revenues. So you’d be right to wonder why the NeXT Personal tests are not contributing to revenues yet.. is it a moonshot product still in development? Is the product an overhyped scam? No, NeXT Personal is being used by over 600 oncologists, has 98% retention(!!) and adoption has been growing exponentially every month for the last 24 months:

Woah, that’s pretty impressive. If NeXT Personal were a startup, VC’s would be tripping over themselves to throw money at them. So why isn’t NeXT Personal showing up in PSNL’s revenues?

Great question. The reason is because the NeXT Personal test isn’t currently reimbursed by Medicare or private insurance yet. As a result, Personalis has been eating the cost of each test as they drive adoption in advance of anticipated Medicare reimbursement in Q4 2025. This has set up a bizarre dynamic where the faster NeXT Personal grows, the larger PSNL 0.00%↑ ’s losses appear.

So when the NeXT Personal test receives insurance reimbursement, a giant revenue spigot that isn’t being captured in their financials today turns on? Yes. That is pretty interesting, but PSNL 0.00%↑ ’s management must be shouting this from the rooftops? The market must have priced this in, surely?

Until 30 days ago, PSNL 0.00%↑ was a $400M market cap company (today it’s $650M and still cheap IMO) so I don’t think many investors are paying attention. But among those who do follow this sector, the general consensus is that tiny Personalis has no hope of scaling their NeXT Personal product against the giant scaled players like Natera ($NTRA, $23B) who currently dominates this market with their Signatera test.

Signatera uses whole-exome sequencing (WES) to create a personalized blood test that tracks 16 of a tumor’s mutations. Signatera is on track to be the most profitable diagnostic test of all time (great blog post by Edward Larkin about Signatera here). 10/7 Update: A reader informed me that Natera now has a new test with 64 variants. That’s still fewer than PSNL’s 1800 and directionally proves that testing for more variants is a good thing.

Personalis is the challenger. Their NeXT Personal test was designed from the ground up on a fundamentally different (and imo better) architecture. It starts with whole-genome sequencing (WGS), giving it a far more comprehensive map of the patient’s cancer. From this superior map, it creates a monitoring panel that tracks up to 1,800 unique tumor variants.

Natera (who until this year was a customer of PSNL, until PSNL launched a competing product), recognized the threat and has recently attempted to counter PSNL by introducing an updated Signatera that also uses a WGS front-end. This test only monitors 16 variants (vs 1800 for PSNL) but allows Natera’s salesforce to create the perception of parity.

For now, the market is assuming that the tweaked Signatera is “good enough”, i.e. doctors will not switch despite PSNL being vastly superior because Personalis doesn’t have the marketing resources to dislodge Signatera. That is the consensus. I believe it is wrong.

Firstly, I think NeXT Personal isn’t just slightly better, it is dramatically better. If a random retail investor with no science background and a ChatGPT subscription can figure this out, I’m pretty sure oncologists can too. Gold standard studies like TRACERx have demonstrated that ultra sensitive tests like the one being pioneered by PSNL have nearly 4x better detection rate in Stage I lung cancer (57% vs. 14% found by a more limited, Signatera-like test) or this paper in GenomeWeb where NeXT Personal demonstrated higher baseline sensitivity compared to another gene-mutation based test (71% vs 30%). Pardon my French, but this is a big F-ing deal, especially for cancer detection. Read those papers and ask yourself which test you’d want your doctor ordering if a loved one unfortunately got cancer?

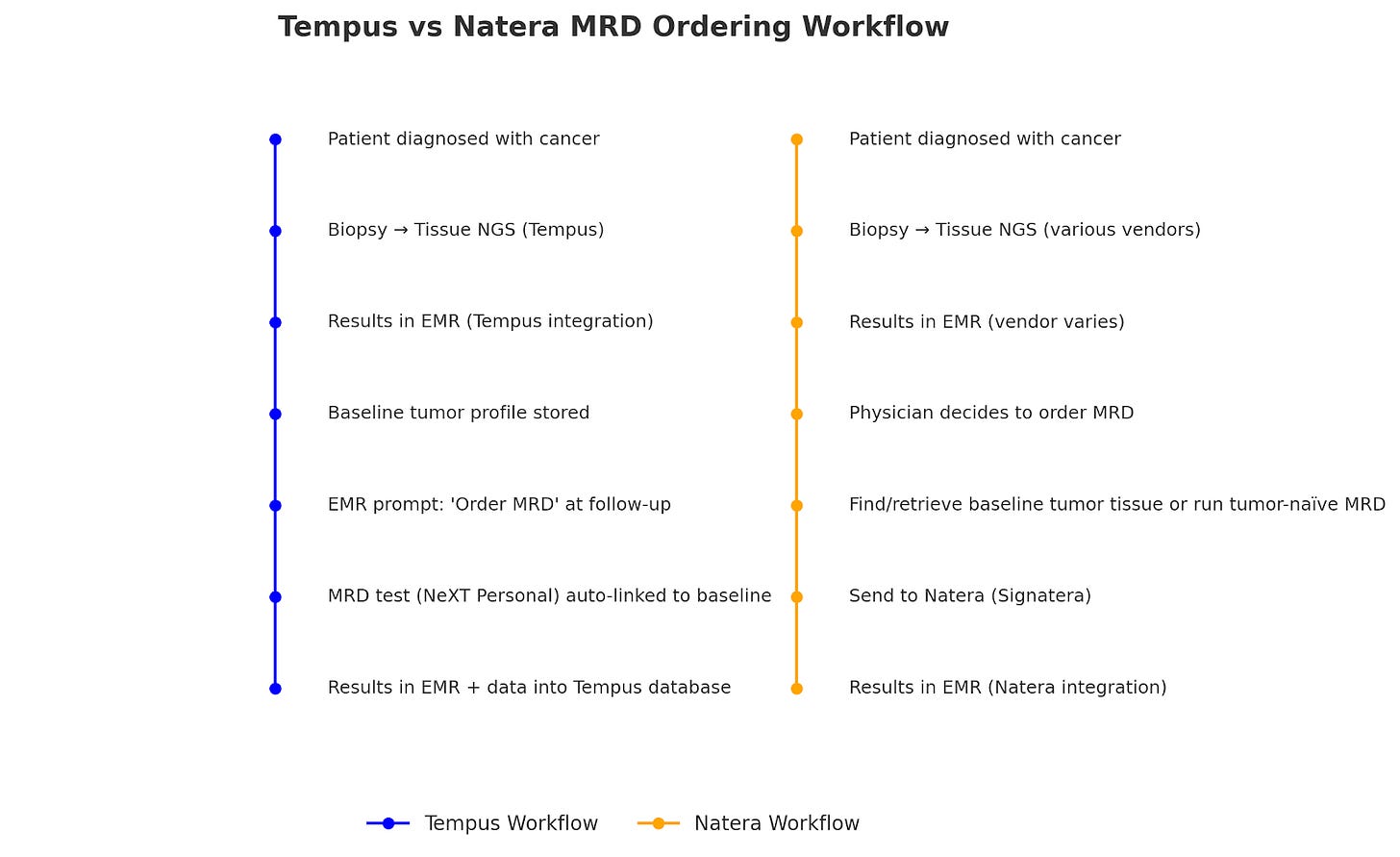

What the market has further failed to appreciate is Personalis’ Go-to-Market strategy. PSNL has embedded their test directly into the workflow of its distribution partner, Tempus ($TEM, $15B market cap), which already has touch points into 50% of oncology practices, runs the biopsy labs for more than 30% of U.S. hospitals and has over 200 full time sales reps. Ordering the test is going to soon be as easy as clicking “add to cart” on Amazon. Billing is already set up, so saying yes takes one click, while saying no means extra work to go outside the system and order a test they already know the patient needs.

Again, I’m not a professional healthcare investor, but I do spend a lot of time mapping workflows and building software products in my day role as a startup founder. I’ve mapped out below what ordering the NeXT Personal test would look like for an oncologist/nurse practitioner once Tempus deploys their one click integration vs ordering Signatera. The key takeaway here is that ordering Signatera will actually require more work than NeXT Personal. People tend to default to the option that has the least amount of friction.

I am making the bet that Tempus will implement this one-click upsell for NeXT Personal. It’s what any half decent product manager would do, and if you spend 5 minutes on Tempus’ website you’ll see that they are pretty damn good at building software. Now might also be a good time to mention that Tempus owns ~14.5% of Personalis and, on Sept 11, 2025, amended their standstill to allow open-market purchases up to 19.99% 👀.

You’d be right to worry that Tempus has all the leverage in this relationship and will make the bulk of the economics. Turns out however that Personalis negotiated a fixed cap of $9.6M on the distribution fee paid to Tempus, laid out in a publicly filed contract that apparently none of the sell side analysts on Wall Street has read, making the NeXT Personal test unit economics incredibly attractive. Here is the contract: https://contracts.justia.com/companies/personalis-inc-8225/contract/1260239/

Why would Tempus give Personalis such a sweetheart deal? Well, Tempus makes gobs of money by anonymizing and selling the genomic sequencing data generated from these tests to pharma companies who use that hard-to-get data to develop drugs. These data licensing deals are extremely lucrative, so Tempus has a strong incentive to help PSNL as much as they can. More tests performed by PSNL = more data for Tempus to sell.

Bonus: If you read the contract I linked above carefully, you will also see that Personalis is entitled to 10-20% of Tempus’ data licensing revenues generated from their tests. It’s early days and its hard to say how big this could get, but this is pure margin revenue for PSNL when it turns on and not at all priced into $PSNL today.

Sidebar: I am in San Francisco at the moment watching a friend’s startup go from $0 to $10M in revenue within a week (true story) after he figured out a way to capture data not easily available elsewhere. No comment on the durability of his business model, but it is undeniable that the big AI labs are all thirsty for proprietary data right now. PSNL’s data licensing agreement with Tempus isn’t core to my thesis, but I do think both Tempus and PSNL are sitting on dramatically under-appreciated data assets.

Valuation

The NeXT Personal test is the core of my thesis. It contributes under 1% of revenue today, yet with 6% market share of MRD recurrence testing I think there is a realistic path to $100M of EBIT by 2029. At a 20x EV/EBIT multiple, this one product alone is worth about $2B against a ~$500M enterprise value today. Could they get more than 6% marketshare? That is upside. Beyond NeXT Personal, Personalis currently makes roughly $85M from three lines of business: biopharma services (with partners like Merck and Moderna), population sequencing supported by government contracts and the aforementioned nascent data licensing deal with Tempus that the market has completely missed. Each of these businesses could be meaningful in their own right but I don’t include them in my valuation.

Imminent Catalyst

PSNL’s breast cancer, lung cancer, and immunotherapy response monitoring tests are expected to gain coverage in Q4 2025 to Q1 2026 (all have been submitted and awaiting MolDx approval for reimbursement). Personalis should then receive roughly six months of retroactive payments, and every additional test going forward converts into recognized revenue. Volumes are already compounding exponentially ahead of reimbursement and management has already signaled that they will step on the gas post reimbursement, so a revenue inflection and dramatic re-rate is around the corner.

Could I be wrong? Sure, and the failure point will be either a) PSNL does not get insurance reimbursement or b) there is an execution stumble - scaling a lab business is orders of magnitude harder than scaling a software business. The former seems unlikely given how strong PSNL’s data is, but you never know. The latter almost feels like an advantage rather than a disadvantage in the age of AI where software increasingly feels commoditized.

Regardless, the downside is limited with 2 years of cash on the balance sheet, no debt, and likely takeout interest from Tempus (who own 14% and just filed to increase that to 19.99%) or Merck (who also own 15.8% of PSNL and have the right of first refusal to mitigate against a take-under from Tempus). If I am right, this is a grand slam. If I am wrong, there’s probably 40% downside from here. Given the probabilities I assign to the two paths, it feels highly asymmetric to me. When I find situations like this, I take my shot ¯\_(ツ)_/¯

Part 2: The Numbers Supporting the Investment Case for Personalis

Value investing is at its core the marriage of a contrarian streak and a calculator. - Seth Klarman, Baupost

Here’s a hedge fund style deeper dive into Personalis covering:

What do they do and how do they make money

How big is the TAM

Unit Economics of the NeXT Personal test

Valuation

Competition

Risks

What Personalis Does and How They Make Money

At its core, Personalis is a genomics company transitioning from a research-focused services business into a high-growth clinical diagnostics company. Its revenue comes from two distinct areas: a legacy biopharma business and a new, rapidly scaling clinical platform.

Biopharma and Research Services

In 2024, this part of the business generated approximately $85 million in revenue and is on track for similar revenues in 2025 despite losing a large contract with Natera who released a competing product.

Personalis provides comprehensive genomic sequencing and data analysis to pharmaceutical companies to support their clinical trials.

Their main product in this segment, ImmunoID NeXT, helps drug developers understand tumor biology and optimize patient selection.

This segment also includes large-scale population sequencing projects for customers like the U.S. Department of Veterans Affairs.

Clinical Diagnostics (The crux of my thesis)

This segment currently generates almost no revenues today. It is centered on two products:

NeXT Dx: A test that analyzes the genetic signature of a patient’s solid tumor to help guide therapy. It has Medicare reimbursement, proving the company can navigate the regulatory and payment landscape.

NeXT Personal: The flagship minimal residual disease test for detecting cancer recurrence. While it is not yet generating significant clinical revenue pending broad reimbursement, adoption is strong, retention is at 98% (Q4 2024 earnings call) with test volumes up 59 percent in the most recent quarter and set to accelerate massively post reimbursement. It is already used and paid for by biopharma customers in drug trials, with that revenue stream expected to grow 300 to 400 percent in 2025.

In short, a growing services business is currently funding the launch of a transformative clinical platform. The value will unlock when reimbursement decisions convert NeXT Personal’s test volume growth into a high margin, recurring revenue stream.

The TAM

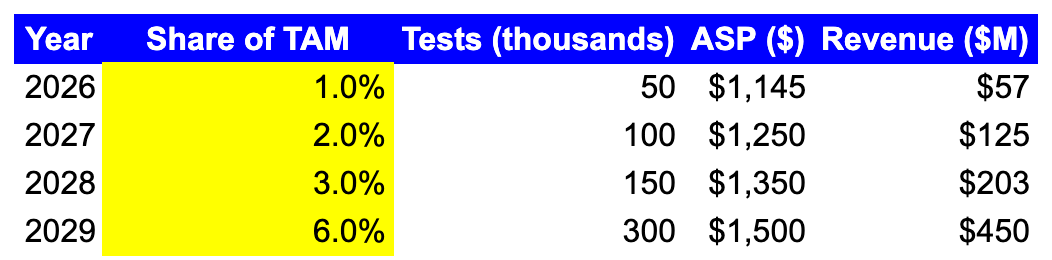

I estimate about 5 million surveillance tests per year in the U.S. across breast, lung, and colorectal cancers (all cancer types PSNL has tests for).

My calculation is based on the number of U.S. patients in major solid tumors who are in the surveillance setting, meaning they have received initial treatment and are now being monitored for recurrence.

First, I do not look at the number of newly diagnosed patients each year (incidence). The true market is the total number of patients who are alive and being monitored at any given time (prevalence). A patient diagnosed with Stage II/III cancer may be monitored for 5 years or more.

I focused on the three largest initial markets for MRD testing (all of which PSNL has a test for):

Breast Cancer: ~300,000 new cases/yr

Lung Cancer: ~240,000 new cases/yr

Colorectal Cancer (CRC): ~150,000 new cases/yr

Together, these three account for nearly 700,000 new diagnoses annually in the U.S.

I estimate that roughly 50% of these patients are diagnosed at a stage (II or III) where they receive treatment with curative intent and then enter long-term monitoring.

700,000 annual cases x 50% eligibility = 350,000 new patients entering the monitoring pool each year.

Assuming an average monitoring period of 4 years, the total pool of patients under surveillance at any given time is: 350,000 patients/year x 4 years = 1.4 million eligible patients.

Testing Frequency: The standard clinical protocol for MRD surveillance is quarterly testing to detect recurrence as early as possible. I assume 4 tests per patient, per year (and I’m being conservative. Medicare allows for up to 1 test per month).

TAM: Multiply the number of eligible patients by the annual testing frequency.

1.4 million eligible patients x 4 tests per year = 5.6 million annual tests.

I round this down to a conservative 5 million annual tests to account for imperfect patient compliance and variable physician ordering patterns.

Note: This number represents only the breast, lung, and colorectal cancer markets. When I include other major solid tumors like bladder cancer, melanoma, and head and neck cancer, the true long-term TAM is substantially larger.

Unit Economics of the NeXT Personal Test

To triangulate the unit economics, we need to know:

a) the average selling price per test (i.e. what the reimbursement rate from Medicare and private insurance companies will be) and

b) how much does it costs PSNL to manufacture and distribute their tests.

Average Selling Price Per Test

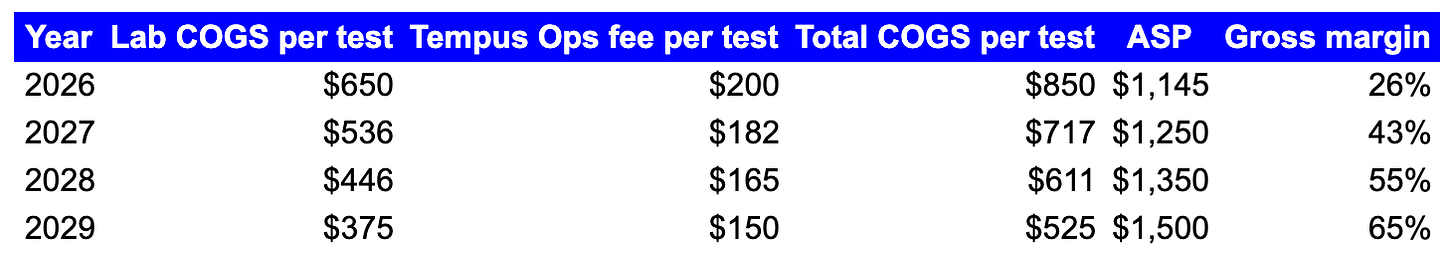

On the Q2-25 call, Personalis’ CFO framed this as “about $7,000 per patient over roughly four tests”, which implies ~$1,750 per draw in a full-reimbursement scenario. While I’d be over the moon if they got this pricing eventually, I think a more conservative scenario is $1145 per test in 2026 (roughly in line with Signatera) which scales up to $1500 in 2029 which feels reasonable given that coverage is likely to broaden and Medicare Advantage/commercial compliance tightens.

After coverage is approved, management plans to apply for ADLT status. Under CMS rules, new ADLTs are paid at list charge for the first three quarters, then reprice to the weighted median of private-payer rates. If granted, this can lift realized pricing above my assumed $1500 base in 2029, but that is upside.

How much does it cost to make a test i.e. COGS

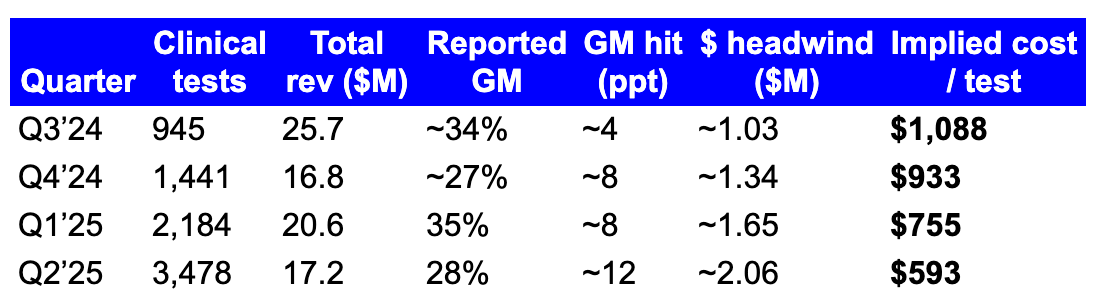

I triangulated today’s lab cost from what the company discloses. Each quarter they provide total revenue, reported gross margin, and the gross-margin headwind from unreimbursed clinical tests. Multiply the headwind percentage by total revenue to get the dollar headwind. Divide by clinical tests delivered to get the implied cost per test. This isolates the cash cost of tests that hit COGS without offsetting revenue.

This shows PSNL’s scale at work: ~$1,088 → $933 → $755 → $593 per test from Q3’24 to Q2’25.

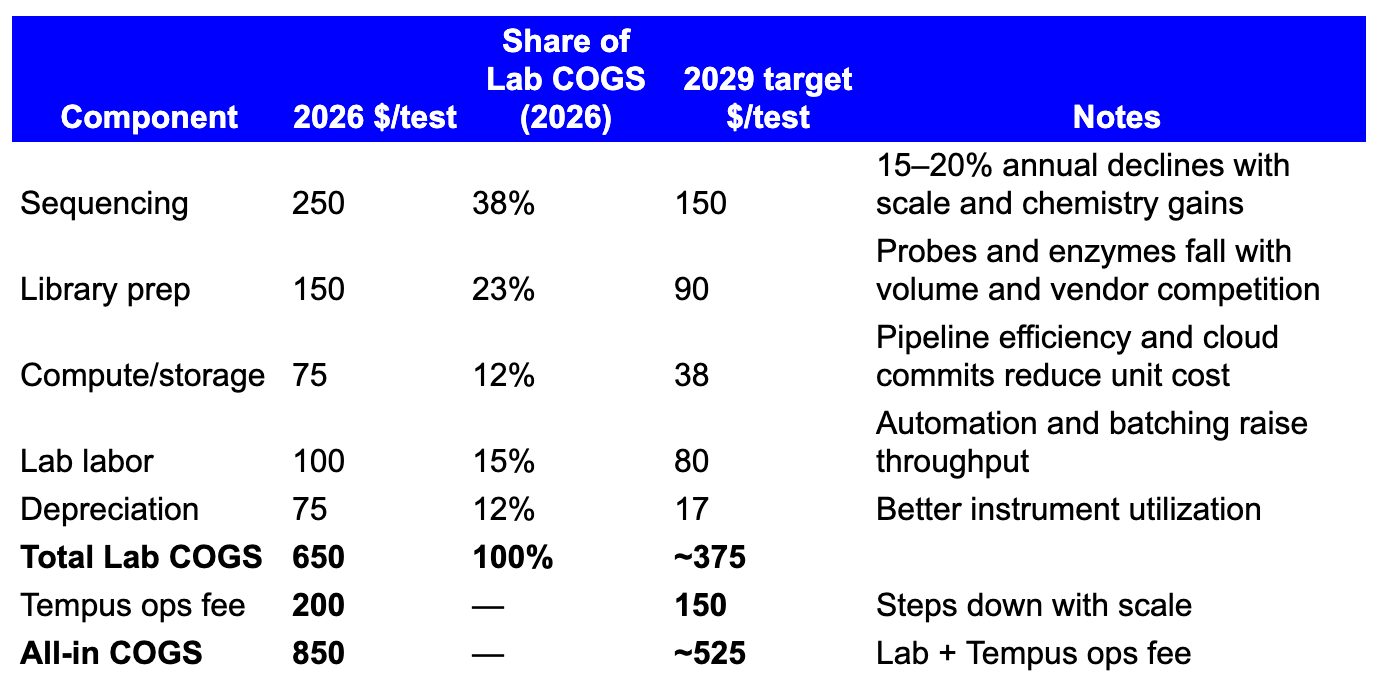

My 2026 base assumes lab COGS of ~$650 per draw plus a Tempus operations fee of ~$200 per draw, for all-in COGS of ~$850. By 2029, lower sequencing and kit costs, tighter pipelines, higher utilization, and a lower ops fee take all-in COGS to ~$525.

One of the under-appreciated aspects of PSNL’s business is that approximately 50% of PSNL’s COGS (sequencing costs and compute) are falling dramatically year over year, driving gross margins higher.

Gross Margin Per Draw

Today: $1,145 ASP minus $850 COGS = 25% unit gross margin.

2029 base case: $1,500 ASP minus $525 COGS = 65% unit gross margin.

How much money can PSNL make from the NeXT Personal Test?

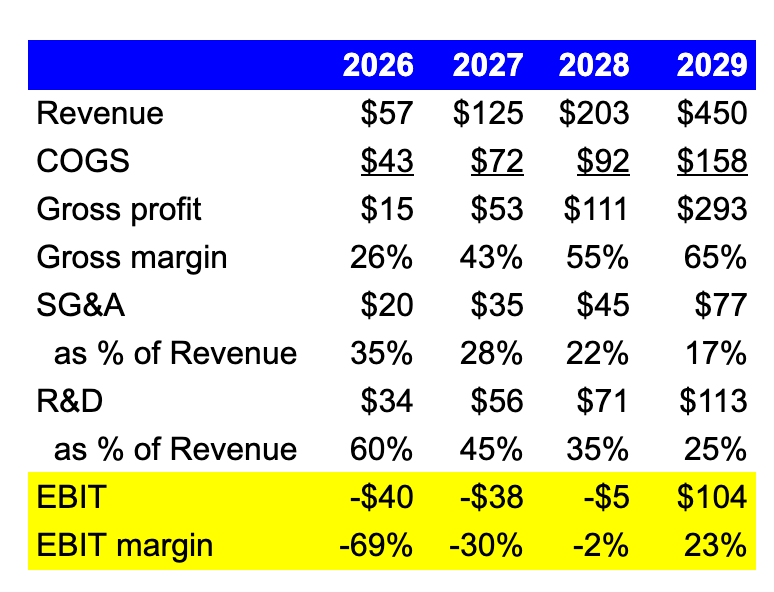

Given PSNL’s superior product and distribution partnership with Tempus, I think there is a reasonable chance they get to 6% market share in MRD cancer recurrence testing in the next 4 years. The ride will probably be lumpy instead of the smooth curve I’ve modeled below, but you get the idea..

As demonstrated above, I think there is a COGS path to about 65 percent gross margin. This is what that could look like:

Operating Expense Discipline: As volumes scale and their platform matures, I think SG&A as percent of revenue can go from 35 percent in 2026, to 17 percent in 2029. R&D as percent of revenue can go from 60 percent in 2026, to 25 percent in 2029. Again, these are broad directional assumptions but it intuitively makes sense. Note: The SG&A and R&D costs should be distributed over their entire revenue base not just NeXT Personal but you get the idea..

Putting it all together, this is how I think NeXT Personal generates $100M in EBIT by 2029.

So the NeXT Personal product alone can do $100M in EBIT in 4 years with some fairly reasonable assumptions. We can debate what the right multiple to stick on this is, but this business is worth a lot more than $500M in enterprise value today. A 20x multiple gets us to $2B.

But wait, there’s more!

PSNL currently does $85M in revenue excluding NeXT Personal. Their biopharma business is actually growing rapidly (after adjusting the loss of Natera as a customer, who launched a rival product and a few delays from pharma customers). I’m doing them a huge disservice by sticking this business at the end and lumping it into “upside” because this biopharma business might just be a whole franchise in itself. Intuitively you can probably grok that any business that can shave off a year from a billion dollar drug trials is probably going to be able to capture a lot of value. That is what this segment has the potential to do.

I’m going to very briefly go through each of these business segments and show some very lazy, conservative, hand wavy math for illustrative purposes. The key take away is that there is significant, explosive, upside inside Personalis.

A) Biopharma testing & services

What it is: Trial support for pharma (tumor profiling/WGS, trial MRD endpoints, regulatory reporting) under MSAs; analytics and dashboards reuse across programs.

2029E economics: EBIT $36M (shared lab/compute leverage from clinical MRD).

Valuation: 15× EBIT ⇒ $0.54B EV.

B) Cancer-vaccine sequencing (option)

What it is: End-to-end sequencing and neoantigen calling for personalized cancer vaccines. This cancer vaccine is almost a bet the company moment for Moderna and they are set to do a read out in Q1 2026. MRD monitoring tail per patient (package ≈ $1.1k per new patient).

I think Moderna has a low probability of succeeding given the difficulty of what they are trying to do and the political environment, so I am assigning $0 to this, but these numbers will look bonkers if they do pull it off.

C) Population sequencing (government)

What it is: Large-scale, grant/award-driven sequencing for public programs; capacity smoothing and reference datasets, with pass-through costs capping margins.

2029E economics: EBIT $9M.

Valuation: 10× EBIT ⇒ $0.09B EV.

D) Tempus data royalty participation

What it is: PSNL share of Tempus third-party data licensing; minimal incremental cost. (Assume $200M 2029 third-party royalties; PSNL at 15% ⇒ $30M revenue.)

2029E economics: EBIT $24M (80% margin).

Valuation: 15× EBIT ⇒ $0.38B EV (strategic, dependency risk).

Valuation: SOTP (midpoints, 2029E)

Core MRD (NeXT Personal): $2.00B

Biopharma testing: $0.54B

Cancer-vaccine option: ?

Population sequencing: $0.09B

Tempus royalties: $0.38B

Total SOTP EV: $3.0B

Discount 4 years at 12% ⇒ PV of $2.0B before net cash and any dilution.

Competition

I’ve framed this as a battle between Natera (Signatera) and Personalis, but Guardant and Quest have competing products too. The reason I don’t spend too much time on competition is because a) I think PSNL has the best in class product and 2) my whole thesis hinges on them getting 6% market share which should be quite do-able given the Tempus partnership.

Risks

Believe, but buckle up - bumper sticker I saw on a Tesla in SF

The single biggest risk is that PSNL gets denied insurance reimbursement and/or there is a major delay. If this happens, be prepared for a 40% chop.

Mitigant: The data is exceptionally strong, the product is already being used by over 600 oncologists in practice and the company is ramping up their own sales team and hiring billing specialists. Every indicator points towards imminent reimbursement approval, but you never know crazy things do happen.Execution risk: What looks like a simple blood draw actually relies on insanely cool and difficult technology. Scaling this up will come with its own challenges. Can they go from 0 to 6% market share in 4 years? There may be some execution stumbles along the way.

Mitigant: They’ve spent the last 2 years eating the cost of the NeXT Personal test precisely to plan for this reimbursement moment when they can step on the gas. That’s sufficient time to iron out most wrinkles.

Conclusion

If you’ve made it here, congrats you are in the top 1% of curious people in the world. I think the risk / reward on PSNL is pretty damn compelling. We will have an answer on the reimbursement question pretty soon and I expect the stock to react violently (in either direction) when that happens. Let’s find out!

Stay curious,Rush

The most compelling part of this story for me is Tempus moving to expand its stake. When a dominant player doubles down, it signals conviction from folks who are more knowledgeable than me. I’m happy to be the silent partner invested alongside them in what looks like a transformative opportunity ahead of PSNL.

What’s your assessment on a fair value price? I’ve been dollar cost averaging my position for a couple months now and would like to exit here at $11.